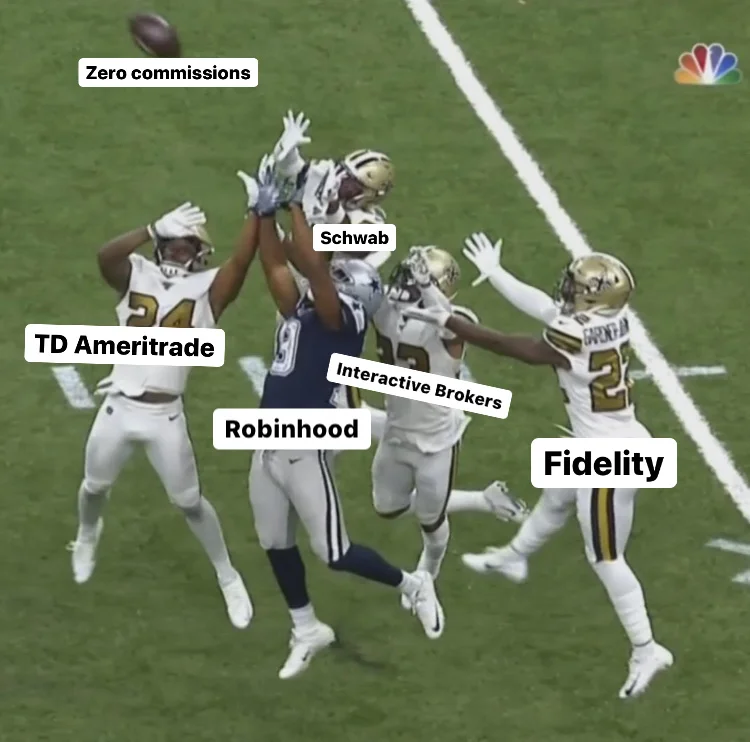

The big news yesterday was Charles Schwab and TD Ameritrade slashing the fees it charges for trades on stocks, funds, and options to zero. This news follows days after Interactive Brokers announced unlimited no-fee trades. Your move Fidelity.

All major public stock brokerages got pummeled on the news. Robinhood is private but you can only imagine what will happen during the next funding round. I guessed they would have dropped 30-40% on the news. My alter ego Michael Batnick said on this morning’s Animal Spirits podcast that they would have dropped 30% on the news. Private market valuation secured.

I remember when I started my trading—I mean investing—journey more than 10 years ago. I was looking for the cheapest fees possible. The cheapest broker at the time was TradeKing who charged $4.95 per trade. TradeKing subsequently got bought out by Ally Invest in 2016. I’m still with Ally—for now—but I am seriously considering moving to Schwab or TD Ameritrade on this news. I don’t make as many trades now as I did in the past, but I also have no loyalty with Ally. I also need a broker that offers a Roth IRA—hence why I’ve never used Robinhood.

The $4.95 fees for both the buy and sell side really added up during my early investing career. There were years where I probably made 200+ trades. These trades were rules based and automatic but I can only wonder how much money I would have saved—or compounded—if I would have had a zero fee option available. Galaxy brain: I wonder how much money I would have made if I would have not traded at all.

Although there is an argument to be made about the quality of the order execution and fill, if you are buying $1,000 or less of stock, those fees can really eat you up. I would assume the majority of Robinhood investors are millennials who make small purchases because of the zero fee structure.

With Robinhood planning their IPO I can only wonder how the race to zero will end for them. This was their first mover advantage. Robinhood will have to think of other ways to be innovative and keep their current user base. I really do hope they come out of this unscathed. We can definitely give them credit for being first to market and forcing the hand of the bigger brokerages. Now they need to focus on their brand and how they will stand out.

Maybe Robinhood will be the first brokerage to start paying us to trade. What’s stopping them?

Now enjoy some jokes that Robinhood didn’t think were as funny as everyone else did.

This is post #39. You can follow me on Twitter or Instagram or sign up for my free newsletter here. Also please check out my Amazon page for a full reading list.