Unless you’ve been living under a rock the past few months, you’ve probably heard of this company that went public recently named Beyond Meat, Inc. (BYND). BYND went public on May 2, where it opened at $46/share. Today it hit over $200/share representing a 200% gain from the first trading day closing price and approximately a 350% gain if you bought on the open. It’s up over 700% from the offering price of $25/share. It has become one of the most talked-about and controversial stocks in the market this year.

I have always been and will most likely always be a meat-eater. I’ve read way too many research papers and books from very smart people and seen the results myself on what a paleo or keto type diet can do for people to cure a host of different ailments. When I see people eating this fake meat crap, I die a little inside. I think it is pure poison. If you look at the ingredients, this is basically a pea protein smoothie that’s put into patty form and served as a meat substitute. Don’t forget that there is also bamboo cellulose (wood) in their ingredient list. But I digress.

We are here to talk about how beyond ridiculous the pricing metrics of this stock have gotten.

I tried to find what I thought would be the closest competitor to BYND. I thought Tyson (TSN), Hormel (HRL), and Mondelez (MDLZ) seemed to be a good fit. You could make arguments for a lot of other packaged companies to be direct competitors but I listed just a few to get the point across. I compared BYND’s fundamentals to a basket of 35 other packaged good companies.

First, let’s look at the simple Price to Sales (TTM) ratio. Let me know if one of these stands out in the chart below. The historical average P/S ratio for the S&P 500 is around 1.5. You can see that BYND is now trading at over a 116 P/S ratio. They better be selling a ton of fake burgers to justify this number. It’s almost as if we’ve already seen this story play out recently with our friends over at Tilray (TLRY). TLRY was trading at a <pause for dramatic effect> 650 P/S back in September of 2018! Want to guess where it’s at now? 69. Nice, but still expensive on a sales basis.

Now let’s take a look at the relative market cap compared to some of its other peers. It’s less than $1B in market cap from equaling Campbell Soup (CPB). Yes, the same Campbell Soup that is celebrating the 150th anniversary of their founding this year. BYND has a net loss (TTM) of $26.8M whereas CPB has a net income of $331M. But they somehow have nearly the same market cap. It’s also stone’s throw away from Conagra, JM Smucker, and Kellogg—iconic American food brands that also sell a bunch of processed crap but have been around for a long time.

Now let’s do employee count. BYND has 383 employees. CPB has 23,000. Or you could split it up by market cap per employee, which is a useless statistic but fun either way.

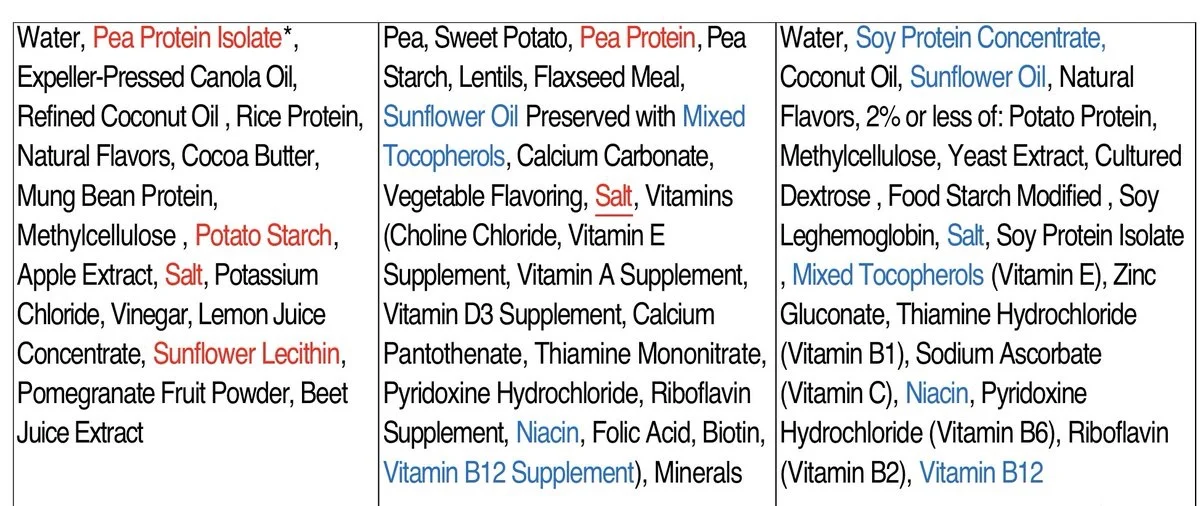

I tried to find packaged food companies with similar employee counts and then compare the other metrics such as market cap and price to sales. I found that Freshpet (FPET) has 382 employees but only a market cap of 1.5B. I thought this was a perfect fit seeing as both FPET and BYND are in effect both serving dog food. Don’t believe me? See if you can spot which of the two options below are fake meat and which one is dog food. Either way, it is all super-processed junk.

One of my Twitter followers also posted a video of himself offering his good boy the choice of a real meat burger versus a fake meat BYND burger. Please watch the results and decide for yourself which one you think is healthier.

I don’t know if this fake meat trend is just a fad. I really hope it is because I think this stuff is outright unhealthy regardless of how it tastes. The problem is even if you do think it’s a fad, it’s really hard to short it if you can find shares available. The option premiums are also extremely elevated. If someone has a good (cheap) way of shorting this please let me know, I am very interested—not investment advice. Any way you slice it, you can pretty much say that the price of BYND is beyond ridiculous.

I have no position in any stocks mentioned explicitly by me in this post but my positions may change from time to time.